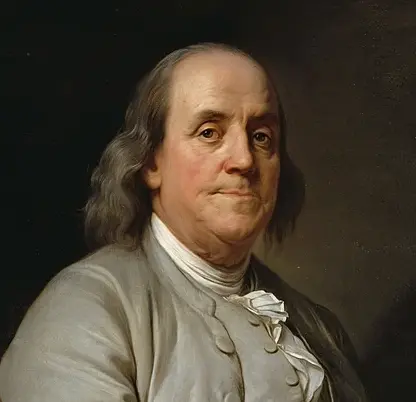

Adam Smith

Historical Figure18th Century Scotland

From An Inquiry into the Nature and Causes of the Wealth of Nations by Smith, Adam

"It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest."

About Adam Smith

Debates featuring Adam Smith

I sold my tech company last year for $800 million. After taxes, I have about $500 million. I'm 45, my kids are set up, and I want to do something meaningful with this money. Some advisors say I should focus on "effective" giving—malaria nets, direct cash transfers to the extreme poor, causes where I can measure lives saved per dollar. "Don't let your personal interests distort your impact," they say. "The arts and culture don't need you—people dying of preventable diseases do." But I love music. I grew up poor, and the public library's CD collection changed my life. I could fund a world-class music education program in underserved schools, or endow a concert hall, or support emerging composers. It wouldn't save as many lives as malaria nets, but it might create beauty that lasts for centuries. My wife says I'm overthinking it: "The money is yours. You earned it through the market, and the market is where it should go back—invest in companies solving problems, create jobs, let the invisible hand work." She thinks philanthropy itself is the wrong approach. What's the best use of wealth that exceeds any person's needs? — The Billionaire's Philanthropy Question in Palo Alto

57 votes

Economics & Social JusticeI inherited an apartment building from my grandmother. She kept rents low for decades—many tenants have been there 20+ years, paying far below market rate. Some are elderly on fixed incomes. Some are families who've built their lives around this affordable housing. I can't afford to do what she did. Property taxes have tripled. Maintenance costs are crushing me. I've been subsidizing the building from my own salary, but I have kids approaching college age and no retirement savings. If I raise rents to market rate, most of these people will have to leave. They can't afford anything else in this city. One woman told me she'd be homeless. My financial advisor says I'm being foolish—"You're not a charity. These people would have had to move eventually anyway. You didn't create the housing crisis." He's right that I didn't create it. But I'm being asked to enforce it. My grandmother sacrificed her own financial security for these tenants. Was that noble or naive? Am I obligated to continue her sacrifice, or is it fair to finally pursue my own interests? — The Landlord's Dilemma in Los Angeles

61 votes

Business & EthicsI own a small manufacturing company with 45 employees. Business is tough right now—margins are razor thin and a competitor just undercut our prices by 15%. They can do it because they pay minimum wage and offer no benefits. I pay above market and offer health insurance. My employees have been with me for years. But I'm bleeding money. My accountant says I need to cut wages or lay off 10 people to survive. My competitor's owner sleeps fine at night. I believe treating workers well is the right thing to do—and I thought it was also good business. But now I'm not sure I can afford my values. Do I compromise my principles to survive, or hold firm and potentially go under? — Nice Guys Finishing Last in Louisville

83 votes

WisdomI recently came into a small inheritance of about $15,000 from my grandmother, which is the most money I've ever had at once. I currently have $12,000 in credit card debt spread across three cards with interest rates hovering around 22%. My friends are telling me I should invest the money in a high-yield savings account or put it into the stock market since the market is down right now. However, the monthly interest charges on these cards are killing me and eating up a huge chunk of my paycheck. Is it financially smarter to wipe out the debt completely and start from zero, or should I pay half of it and invest the rest so I have some emergency savings? I’m 28 and really want to start building wealth, but this debt feels like a weight around my neck.

88 votes

Money & EthicsI inherited $12 million when my father died last year. I didn't earn it. He built a manufacturing company that, frankly, wasn't always ethical in how it treated workers or the environment. Now I have this money and I don't know what to do with it. Part of me wants to give it all away—to the workers' families, to environmental causes, to just... not have it be mine anymore. It feels dirty. I feel like a fraud living in my modest apartment while millions sit in accounts. My financial advisor thinks I'm insane. "You can do more good over time with strategic philanthropy," he says. "Keep the principal, give the interest." My therapist says my guilt is misplaced—I'm not responsible for my father's choices. But every morning I wake up and think about St. Francis stripping naked in the town square, giving everything back to his merchant father. Is radical generosity wisdom or foolishness? Can you do good with money that was made badly? — Rich and Empty in Rye

89 votes

Similar Mentors

Ready to consult Adam Smith?

Get personalized advice on your real-world challenges